Virtual cards & payments

Simplify business spending with virtual cards

Company spending is stress-free with virtual cards. Pay securely and efficiently with our digital payment solution.

Integrated with 1000s of partners

Virtual cards make business spending simple and secure

Manage payments effortlessly with virtual cards. Control how you and your employees make payments online, in-store, in-app or in transit.

-

Safe and secure payments

Use virtual cards to reduce the risk of fraud and unauthorised use by ensuring payments are pre-approved. Set spending limits and restrict card usage to specific vendors or categories. Easily deactivate or modify cards and configure transaction parameters to align with company policies.

-

Simplify expense management

Without physical cards to issue and monitor, virtual cards simplify expense management and reduce time-consuming admin. Sync and capture spending on desktop or mobile with real-time visibility of virtual payments. Automatically reconcile purchasing and transaction data from over 75 banks and 100 purchasing platforms.

-

Pay staff expenses across the globe

Use virtual cards for all kinds of transactions, including hotel bookings, airline tickets, car rentals, and more. Our virtual cards are accepted across our vast global supplier and vendor network, giving you flexibility and convenience wherever and whenever you need it.

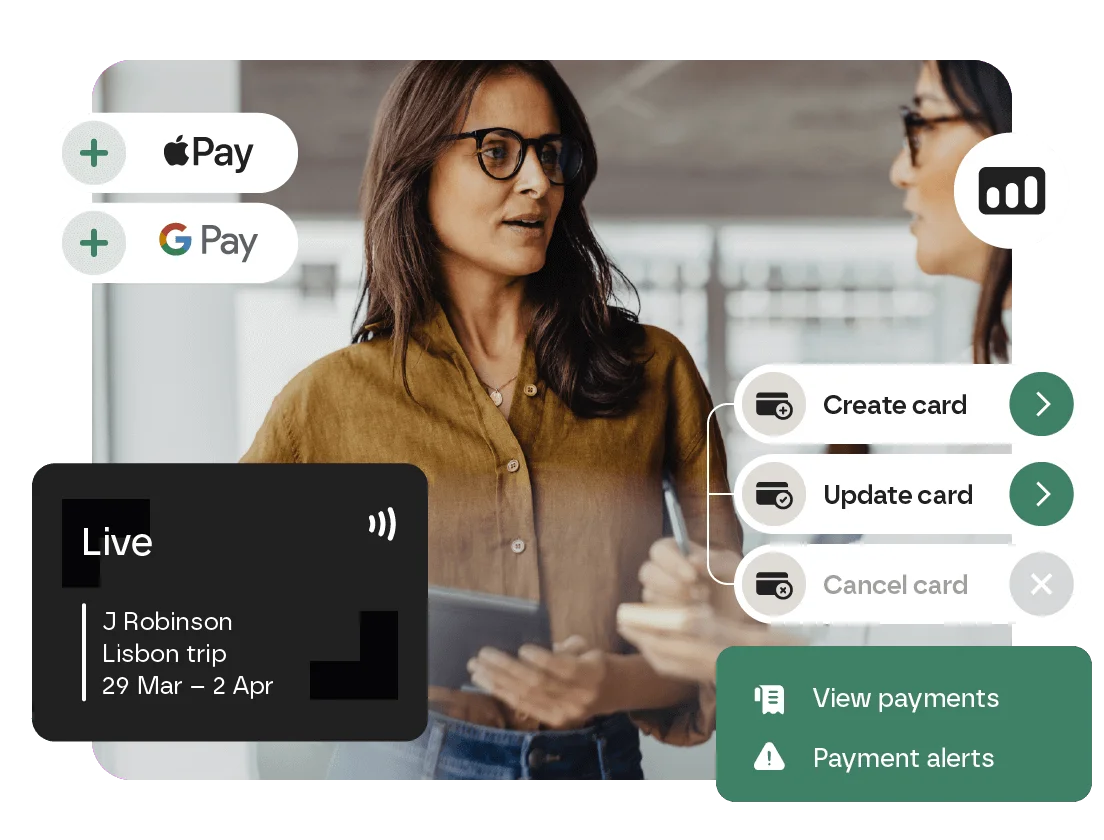

What virtual cards can do for your business

Track employee spending

Extend virtual cards to your employees so they can pay for business expenses online, in-store, in-app or in transit. Add cards to digital wallet and enable employees to pay via Apple Pay or Google Pay. Get real-time spending alerts and receive notifications about employee payment transactions. Monitor payment activity, identify potential issues, and take prompt action.

Centralise corporate travel payments

Use virtual card payment to centralise corporate travel payments, auto-reconciled against project codes and cost centres. All purchase data is automatically matched to your payment data and provided online in a single view.

Embed virtual cards

Embed cards into your accounting processes to pay supplier invoices quicker and improve cash flow. You can even use virtual cards for your bespoke payment flows, such as insurance, healthcare, freight, passenger disruption and more.

Partnered with trusted businesses worldwide

We collaborate with global travel management companies, trusted banks, online booking tools, and global distribution systems to deliver safe and secure payment solutions for businesses worldwide.

How corporate virtual cards work

Create virtual cards in three easy steps, and provide your business with a secure, and hassle-free payment solution.

-

01

Create a virtual card

We connect with corporates and companies to issue virtual cards to their employees or departments using their preferred issuer. Then, Conferma receives and validates with the issuer each payment card request. Once approved, we provide the necessary virtual card details, such as card number, CVV, and expiration date, to the authorised users. These virtual cards can be customised with specific spending limits and usage restrictions based on the company’s policies.

-

02

Make the payment

When a team member needs to make a business-related purchase or payment, they can use the virtual card details provided by Conferma to pay online, in-store or in-transit. The transaction amount is charged to the virtual card, and the team member can complete the payment process hassle-free.

-

03

Supplier charges the card

Transaction data is sent from the banking partner to Conferma daily. We automatically match the payment data to the virtual card data to provide an auto-reconciled credit card statement, streamlining expense tracking, accounting, and reconciliation processes. As the cards are either Visa, Mastercard or AmEx, they’re accepted globally at 100 million merchants, enabling regular payments to be processed.

See how we’ve helped businesses like yours

View all case studiesAmerican Express Global Business Travel

AMEX GBT - End to end automated data enrichment and invoicing with Conferma snap+.

Read case studyHSBC

Simplifying supplier payments by implementing virtual card number technology powered by Conferma.

Read case study

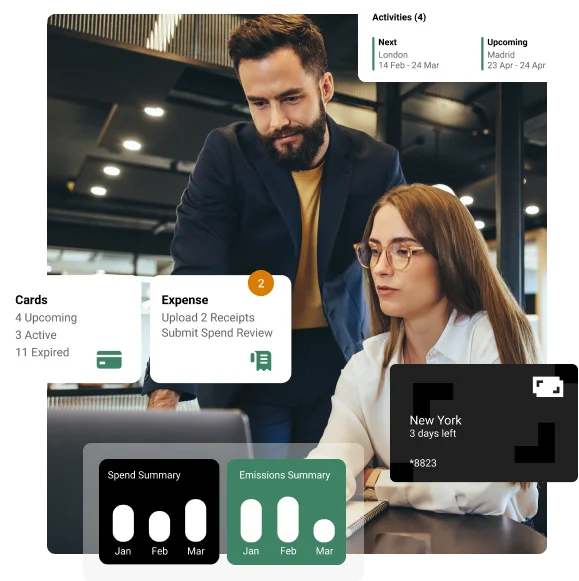

Go mobile with the Conferma payment app

The Conferma mobile app offers convenience, instant virtual card issuing and real-time transaction monitoring. This way, users can efficiently manage corporate expenses with control and flexibility wherever and whenever they need to.

Access virtual cards in the app, anytime, anywhere

Our mobile app allows users to access their Conferma account anytime, anywhere, by requesting a card through the app when they need to make business payments. Users can easily view virtual cards, track transactions, and monitor expense details on the go.

Payment reporting, in real-time

Monitor transactions in real-time and get instant visibility into payments made with virtual cards. This feature keeps you updated on spending activities and helps quickly identify unauthorised transactions or discrepancies, so you can take action when it’s needed.

Quicker business payments

Generate virtual cards directly to mobile devices for faster payment. This feature means you don’t waste time waiting for manual card requests or delays and ensures employees can access payment methods instantly.

Business travel made easier

Book and manage travel arrangements in one place, including flights, hotels, and car rentals. Our app offers real-time updates, notifications, and easy access to travel itineraries.

Explore more of Conferma’s platform

Making your industry our business

Our payment technology helps organisations across different industries.

Discover how we can help your business.

Virtual card FAQs

-

Can you only use virtual cards for a single payment?

No, most virtual cards can be charged multiple times up to the credit limit set on the card. However, when you request the virtual card, you may be able to restrict how many payments can be made to the card to suit your payment use case.

For example, it might be that you want a hotel to charge multiple times to a card up to the credit limit, but when you pay an invoice, you may want to ensure that the supplier charges the card once for the exact amount.

-

Can I use virtual cards to avoid my employees paying for business expenses on their personal cards?

Yes, this is an ideal use case. You can use virtual cards to centralise payments, improve control and allow your employees to pay on the go.

-

Can I provide my cost centre or project code when requesting a virtual card?

Yes, you can provide multiple custom reference fields when requesting a virtual card which will then automatically sync with your payments to optimise your reconciliation process.

-

Do virtual cards reduce misuse?

Yes, because virtual cards are requested pre-purchase, the requestor or system provides additional controls to the card to appropriately restrict payments activity, reducing any misuse opportunity. Dependant on the workflow, you may also implement a pre-approval process where a manager can approve the issuance of a card to an employee.

Unlike physical corporate cards that have a fixed open credit limit allowing employees to make payments without approval, virtual cards request the credit limit for a specific purchase.

-

Can virtual cards be shared with a group?

Yes, Conferma allows for virtual cards to be shared with a group of users. This feature enables businesses to allocate virtual cards to multiple individuals or departments. Each user within the group can access the shared virtual cards according to their assigned permissions and spending limits. However, these settings must be made by the administrator for security purposes.

Book a virtual card demo

Book a demo with Conferma and discover how virtual cards can optimise your payment process.