Virtual Credit Cards

Understanding Virtual Credit Cards

An increasingly popular payments innovation for businesses, virtual cards (often referred to as virtual credit cards) are a plastic-free, digital version of traditional credit cards. In this article, we’ll explore what virtual credit cards can be used for, how they work, and what to do if you want to get started using them.

Just like physical cards, virtual credit cards carry an expiry date, cardholder name, and security code. However, unlike their physical counterparts, virtual card numbers are generated digitally at the point of sale for a specific, single purchase.

Conferma’s Growth Ignition Index Report found that 88% of businesses surveyed are currently using virtual cards or considering it, and findings from Juniper Research estimate that virtual cards will hit a transaction value of £6 trillion by 2026, with more and more organisations realising their value.

What can virtual cards be used for?

In short, virtual credit cards can be used anywhere you would use a traditional corporate credit card. Whether it’s to pay suppliers, book travel, or for staff expenses, virtual credit cards offer a versatile and secure way to manage business payments.

How virtual cards can be used for expenses

Issuing physical credit cards to all employees is an unviable option for most businesses, leaving many with lengthy expense reimbursement processes that offer limited visibility of employee spend. By leveraging virtual cards, businesses can centralise expense payments, improve spending control, and allow employees to pay on the go.

Virtual cards enhance financial management practices and ensure that funds are used appropriately and effectively. Businesses can digitally deploy virtual cards straight to employees which can then be added to their smartphone’s digital wallet. As cards are created for a specific purpose, spending limits are aligned with internal policies, reporting is enhanced, and the time spent on reconciliation is drastically reduced.

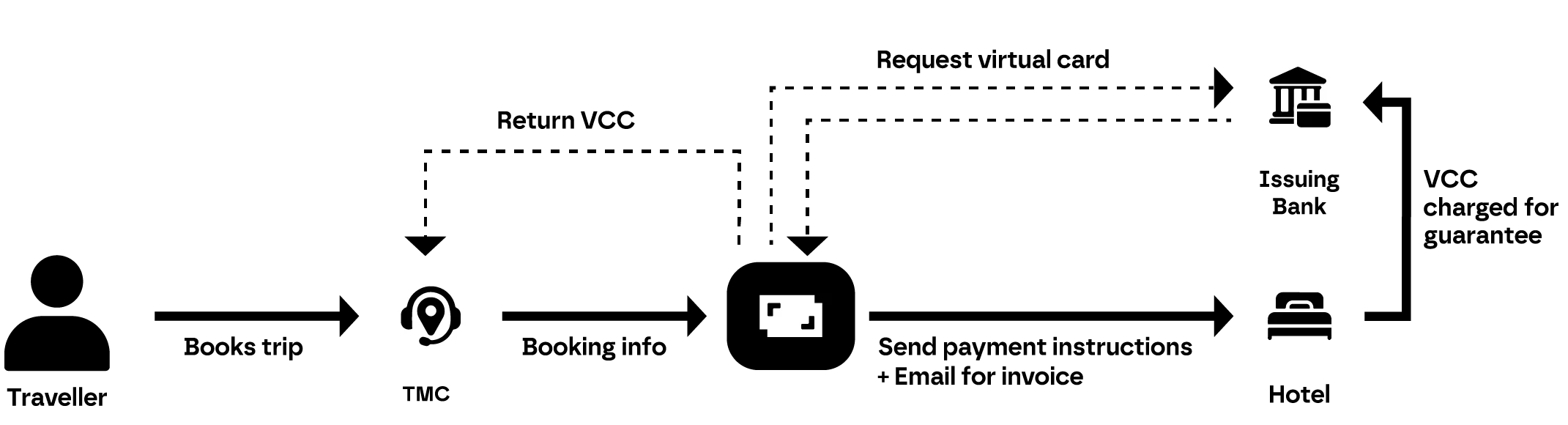

How virtual cards can be used for travel and hotel

Using virtual cards for corporate travel, specifically hotel spend, is the perfect use-case.

Pre-trip –

- A traveller books a trip with their preferred travel management company.

- The booking information is sent to Conferma who then requests the virtual card from the preferred issuing bank.

- The virtual credit card details are sent back to the travel management company.

- Conferma send the payment instructions and email for invoice directly to the hotel who charges the virtual credit card for guarantee.

On trip –

- The traveller downloads the Conferma app to access payment details upon check-in to the hotel (as a back up).

- The hotel charges the virtual card via the issuing bank.

- The traveller checks-out.

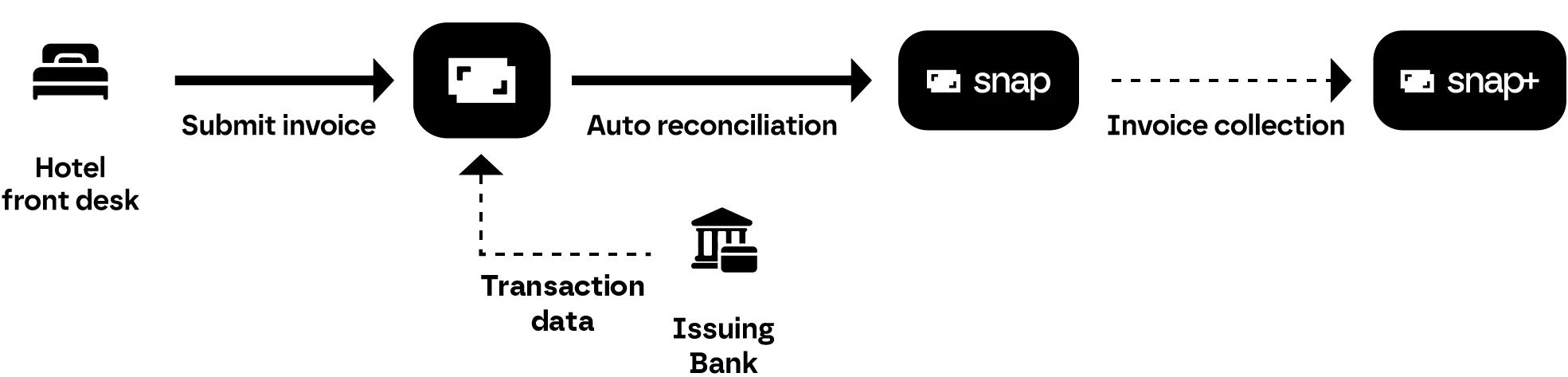

Post-trip –

- The hotel sends the invoice to Conferma.

- The bank sends transaction data to Conferma for automatic reconciliation (snap).

- With the option for outsourced hotel invoice collection (snap+).

How do virtual credit cards work?

The virtual credit card process is made up of three steps.

-

01

Create a virtual card

The virtual card is created. At Conferma, we connect businesses to their preferred card issuers. When a business requests a new virtual card, Conferma validates this with the issuer and once approved, provides the business with the virtual card details

-

02

Make the payment

Next, the virtual card details are used to make a purchase.

-

03

Supplier charges the card

Finally, the supplier charges the card. Transaction data is sent from the banking partner to Conferma every day. We automatically match this to the virtual card data to provide a reconciled credit card statement

Are there security risks with virtual cards?

Virtual cards are a secure way of making business payments. As virtual cards are generated for a single purpose, they are loaded with a pre-agreed monetary value approved by a manager that cannot be exceeded. This significantly reduces the risk of misuse, as the virtual card will automatically decline if the user attempts to spend over their limit.

As well as a spending limit, further control is available through custom spending restrictions. For example, businesses can specify the card’s expiry date, geographical locations approved for use, and Merchant Category Codes that can be charged.

Virtual credit cards also benefit from the same level of protection you would expect from traditional credit card purchases, including allowing the cardholder to instigate a chargeback.

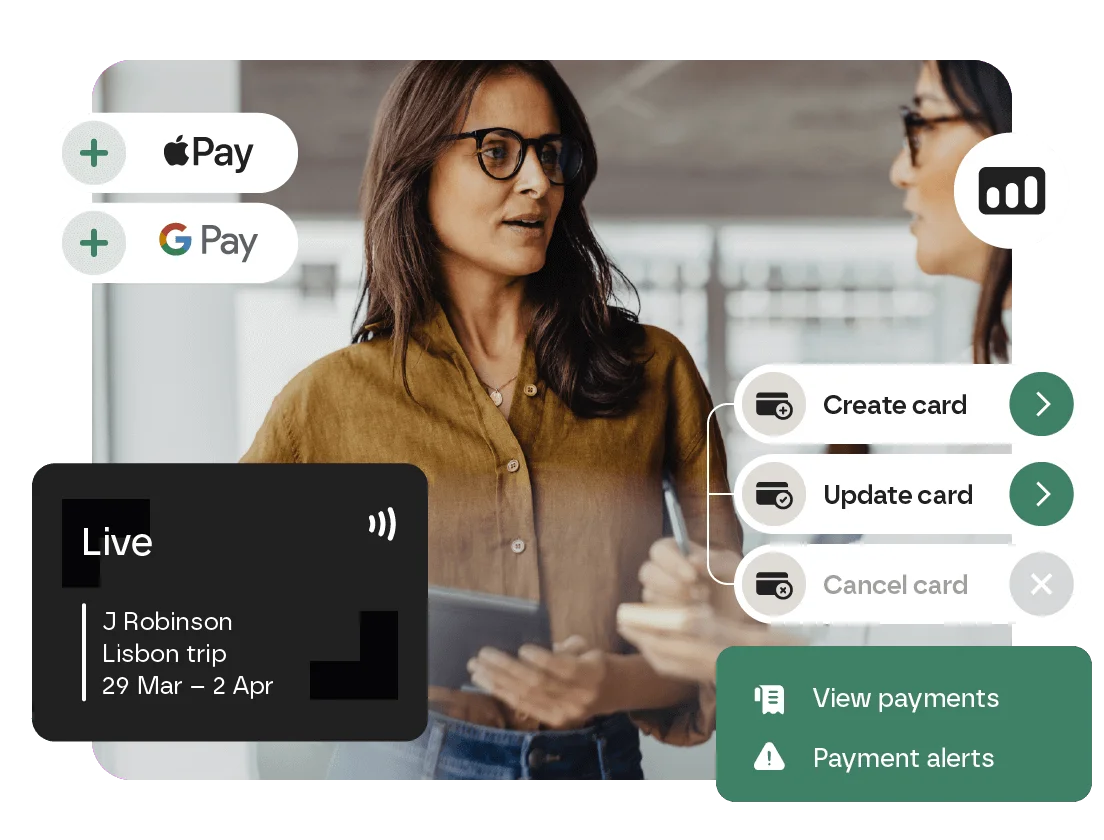

How to set up virtual cards with Conferma

Conferma are a technology partner that supports 80+ card issuers. The first step if you want to use virtual cards is to check if we’re connected to your preferred issuer. If we are, all you have to do is contact them and let them know that you would like to start using virtual cards.

If you’re looking to use virtual cards to book travel through your Travel Management Company, you will also need to contact them to request activation.

After this, we’ll work with your Issuer and Travel Management Company to get your account setup and ready for use.

Once live, you’ll have access to product guides and demonstrations, as well as the Conferma knowledge bank to get you using your virtual cards with confidence.

Check out our setup guide for the full checklist of activities required to get your virtual card account ready.

How businesses can accept virtual card payments

From a supplier perspective, virtual credit cards should be charged in the same way as a physical credit card. The only significant difference is that there is no physical card present. For hotels, this means a virtual credit card can be charged as a card-not-present transaction.

Virtual credit card FAQs

-

Can virtual cards be shared with a group?

Yes, Conferma allows for virtual cards to be shared with a group of users. This feature enables businesses to allocate virtual cards to multiple individuals or departments. Each user within the group can access the shared virtual cards according to their assigned permissions and spending limits. However, these settings must be made by the administrator for security purposes.

-

Can you withdraw cash using a virtual card?

No, virtual cards cannot be used to withdraw cash. This provides an additional layer of security, protects against misuse, and helps with reconciliation as there is a direct relationship between each virtual card and the purchase it is used for.

-

What do I do if I need to refund a virtual card payment?

Refunding a virtual card payment is just the same as refunding a payment made on a physical credit card. You can follow exactly the same process.

Book a virtual card demo

Book a demo with Conferma and discover how virtual cards can optimise your payment process.