What are traditional travel expense drawbacks?

There are several challenges associated with traditional travel expense processes. Typically a manual administrative process that employees have come to dread, the margin for human error is high.

From simple errors such as typos, through to bill miscalculations, and even non-compliant spend, the cost of reviewing and correcting expense claims can be huge for businesses.

In fact, GBTA estimates that it can cost as much as $52 and 18 minutes to correct just one expense report, alarming figures when you consider that roughly 19% of all reports contain errors. These issues are only compounded for larger businesses with huge volumes of expense claims being submitted each month.

Meanwhile, employees are left dreading the end of month expense reimbursement process, with 2 in 5 reporting stress due to the time it takes to be repaid. From desperately searching through old receipts, to anxiously awaiting approval, employees are not only left out of pocket by traditional expense processes, they’re also dedicating significant time to these administrative tasks and finding themselves pulled away from their main priorities.

The Growth Ignition Index Report found that this time quickly adds up, with the average employee spending three hours and twelve minutes each week on financial tasks – that’s almost seven days a year spent distracted from strategic activity.

One thing is clear, traditional expense processes aren’t working for anyone, either business or employee.

How a reconciliation platform can benefit travel expense control

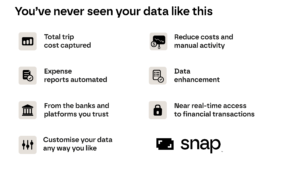

Conferma’s platform offers a solution. By connecting to all of your banking partners in one central platform, snap allows you to visualise your expense data, track spend in near real-time, and understand expense trends.

Conferma snap is a reconciliation and reporting service that gives a complete audit trail of corporate spend. Once an expense payment has been made using a virtual card, data is then sent to Conferma, where our automated systems match purchase data to payment data each day and present this online in a single view.

This allows you to access a comprehensive overview of all travel expenses across your business. The data captured can be customised with additional management information to enhance reporting transparency and data files can feed directly to your banking partner and Expense Management System if needed.

By having a centralised view of travel expenses, you can quickly begin to identify spending patterns. Understanding exactly where your travel spend is being used means that you can proactively adjust your policies and supplier contracts as needed – saving you money in the long run.

Connecting travel expenses and virtual cards

Virtual cards are a secure payment solution that make business transactions simple. Plastic-free, digital versions of traditional credit cards, they can be used anywhere you would use a corporate credit card.

When it comes to travel expenses, virtual cards can either be requested by employees or digitally deployed by managers. Admin controls mean that every card generated is fully compliant with internal policies. In practice, this means that you can set different spending limits or permitted merchant codes depending on traveller type.

Employees can add virtual cards straight to their smartphone’s digital wallet, offering the tap and pay functionality that they’re used to using every day. Expense receipts can then be uploaded immediately through a mobile app, saving employees the hassle of extensive post-trip admin.

The result? Employees have the freedom and flexibility to spend on the go without being left out of pocket, you have complete visibility of all purchases and control over spend, and the need for lengthy, repetitive reimbursement tasks is eliminated.

How to incorporate digitised expense management with Conferma

Conferma’s virtual card platform makes managing your travel expenses simple. We’re connected with hundreds of Travel Management companies, more than 175 online booking platforms, and over 80 card issuers, meaning you can access virtual card technology through your trusted partners.

Get in touch with our virtual card specialists today to learn how our platform can centralise and simplify your travel expenses.

Back to resources

Back to resources