Why travel with virtual cards?

Secure. Efficient. Simple. As a travel payment solution, virtual cards offer many benefits for both businesses and their employees.

Put simply, a virtual card is a digital version of a traditional payment card. Virtual cards share many familiar features with their plastic counterparts, including a long card number, security code, expiry date, and CVV.

Where virtual cards differ is that they offer enhanced security with custom spending controls that restrict when and where they can be used – whether that’s geo-locations, merchant category codes, or even active timeframes. Virtual cards are also typically generated for a single, specific purpose rather than being reused repeatedly across different trips.

In the world of travel, virtual cards can not only be used to securely book transportation and pay for hotels, they can also be sent directly to travellers’ phones through a travel companion app to cover on-trip expenses too.

What can employees find within a corporate travel app?

Business travel apps allow you to give employees access to relevant information and resources at their fingertips. Conferma’s app for business travel, for example, offers employees prompts at every stage of their trip to ensure everything runs smoothly.

Within the app, travellers can view their booking information, request virtual cards, upload receipts, and even push cards to their smartphone’s digital wallet for simple spending on the go.

Pre-trip

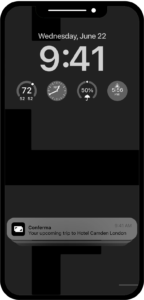

Once a booking is made, your travellers will receive a notification to confirm their trip:

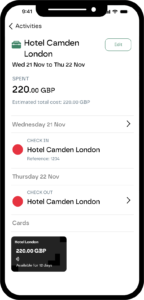

They can then log into the app to see a full trip summary, including flight bookings, when they check in and out, and the hotel where they will be staying:

On-trip

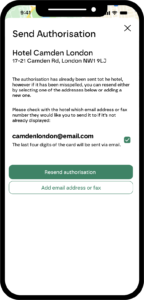

When it comes to the check-in process, the hotel will already have received full payment instructions when the booking was made. However, if needed, your travellers can resend these directly from the app:

Post-trip

No more lengthy post-trip expense reports, your travellers can simply snap a photo of their receipts in-app as soon as a purchase is made:

Benefits of using virtual cards for employee travel

Using virtual cards for corporate travel management offers many benefits to you, your travellers, and your finance teams.

Security and peace of mind

Virtual cards offer a safe and secure way to pay. In fact, 46% of businesses already using virtual cards cited improved security and reduced fraud risk as their primary benefit.

At the most basic level, as employees don’t have to carry a physical corporate card, they don’t have to worry about a piece of plastic being lost, stolen, or copied.

From a more technical point of view, virtual cards are generated with a specific monetary value related to their purpose, rather than the dangerously high spending limits typically available on corporate credit cards. This, when combined with the custom spending controls mentioned earlier, significantly reduces the potential for misuse.

No tiresome admin

The post-trip expense report. A dreaded piece of admin that can cost both employees and finance teams alike hours of precious time. For employees left waiting out of pocket, it’s not just time they’re sacrificing either, 2 in 5 have reported stress and 3 in 10 have experienced personal cashflow issues as a result of lengthy expense reimbursement processes.

Of course, your finance team can’t issue physical corporate cards to everyone who travels, which is where virtual cards come in. Virtual cards allow travellers to digitally access company credit on-the-go. With admin as simple as snapping a photo of receipts as they go, travellers get to avoid lengthy post-trip admin, and your finance team gets full visibility of spend data in one central platform.

Simplified travel bookings

Different traveller types, changing preferences and expectations, fragmented data – booking travel can be complex. Travellers want choice and flexibility, you want control and visibility, and balancing the two can be a delicate process.

With that in mind, making booking simpler wherever possible is a key priority. With virtual cards you can leverage your preferred TMC and embed payment directly into your existing process. Instead of wasting time manually inputting details from corporate cards, virtual cards can be generated almost instantly with a single click when a booking is made – simple.

How to incorporate virtual cards for employee travel

As with any new technology, to be successful, it’s important that your travelling employees understand what virtual cards are, how to use them, and why your business has chosen to adopt them.

For travelling employees, the benefits are extensive – less time spent stressing about how payment will be made, keeping track of a physical corporate card, and potentially being left out of pocket because of a trip.

Conferma are experts in virtual card technology. We’re connected with hundreds of Travel Management companies, more than 175 online booking platforms, 80+ card issuers, and all major card schemes and GDSs, making it easy to centralise your corporate travel spend.

Interested? To get started, get in touch with our virtual card specialists today to learn how our platform can help you.

Back to resources

Back to resources