Banking partners

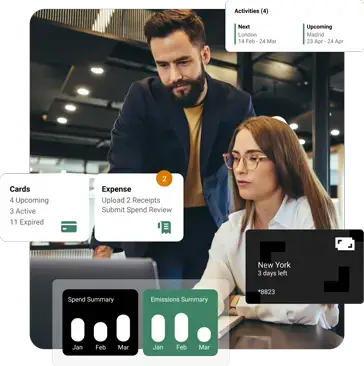

Simplify payment management with our banking solutions

Access one centralised platform for all your banking partners. Use it to issue virtual cards, capture business spending and reduce misuse.

Integrated with 1000s of partners

One platform for banking

-

Solutions for card issuers

Leverage our platform solutions and connected B2B ecosystem to streamline your corporate customer's payment processes.

-

Your brand, our technology

Our technology makes it simple for your business to handle payments. We provide one place to connect with all your banking partners.

-

Seamless payment journey

Integrate and embed within third-party apps to tap into a consistent payment journey. Experience flexible, secure and efficient banking solutions tailored to your business.

-

Automated data reconciliation

One platform for all your banking partners makes reconciliation easier. Simplify your payment processes with line-by-line breakdowns of data and comprehensive insights.

Why banks and card networks partner with Conferma

Rebrand your banking solutions

Connect with us for a seamless payment experience tailored to your identity and branding. We’re continuously developing our innovative banking solutions so you can sell directly to your corporate customers.

Seamless connection

We make your life easier by seamlessly connecting your platforms with Conferma. That means you get real-time transaction handling, data retrieval, reporting, and protection against exchange rates through our localised bank partners.

Reduce security and misuse

We take security seriously at Conferma. That’s why we employ state-of-the-art protocols to protect your sensitive financial data. We’re PCI DSS Level 1 and ISO27001 compliant, so rest assured you’re in safe hands.

Partnered with trusted businesses worldwide

We collaborate with global travel management companies, trusted banks, online booking tools, and global distribution systems to deliver safe and secure payment solutions for businesses worldwide.

Explore Conferma’s platform

Banking partners FAQs

-

How many banking partners can you use in one system?

Our system is connected with 75+ banking partners, but if a customer works with a banking partner we don’t have on board, they can encourage their bank to contact us. Customers can express their interest through our website or events, enabling us to gauge demand and forge new partnerships accordingly.

-

How Conferma chooses partners

Conferma is open to collaborating with all banking partners. We evaluate indicative volume and use cases to ensure a mutually beneficial partnership. There is no bank that we would decline to work with.

Many customers work with multiple banks, and in such cases, they can utilise the same API connection and simply onboard a new card account with the new bank. This scenario is particularly common among OTAs (Online Travel Agents).

-

How Conferma provides safety whilst purchasing

With traceable data, any transactions you didn’t submit can be traced by employees and banks to prevent scams and fraud. Not having a physical card further reduces the risk of financial loss due to fraudulent activities.

Book a virtual credit card demo

Book a demo with Conferma and discover how virtual cards can optimise your payment process.